The 4000+ Year Lottery - Why I'm mining Bitcoin Anyway.

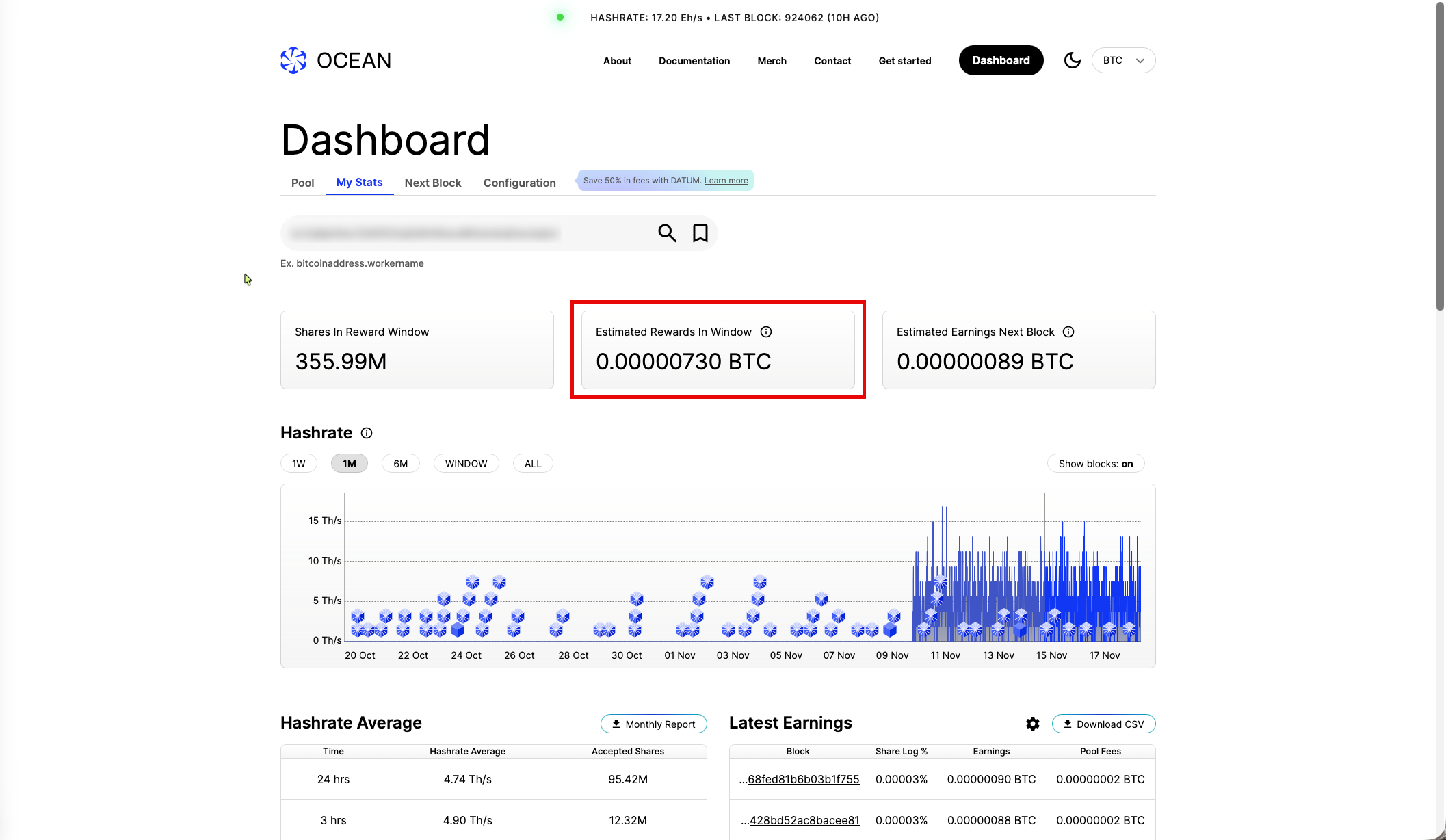

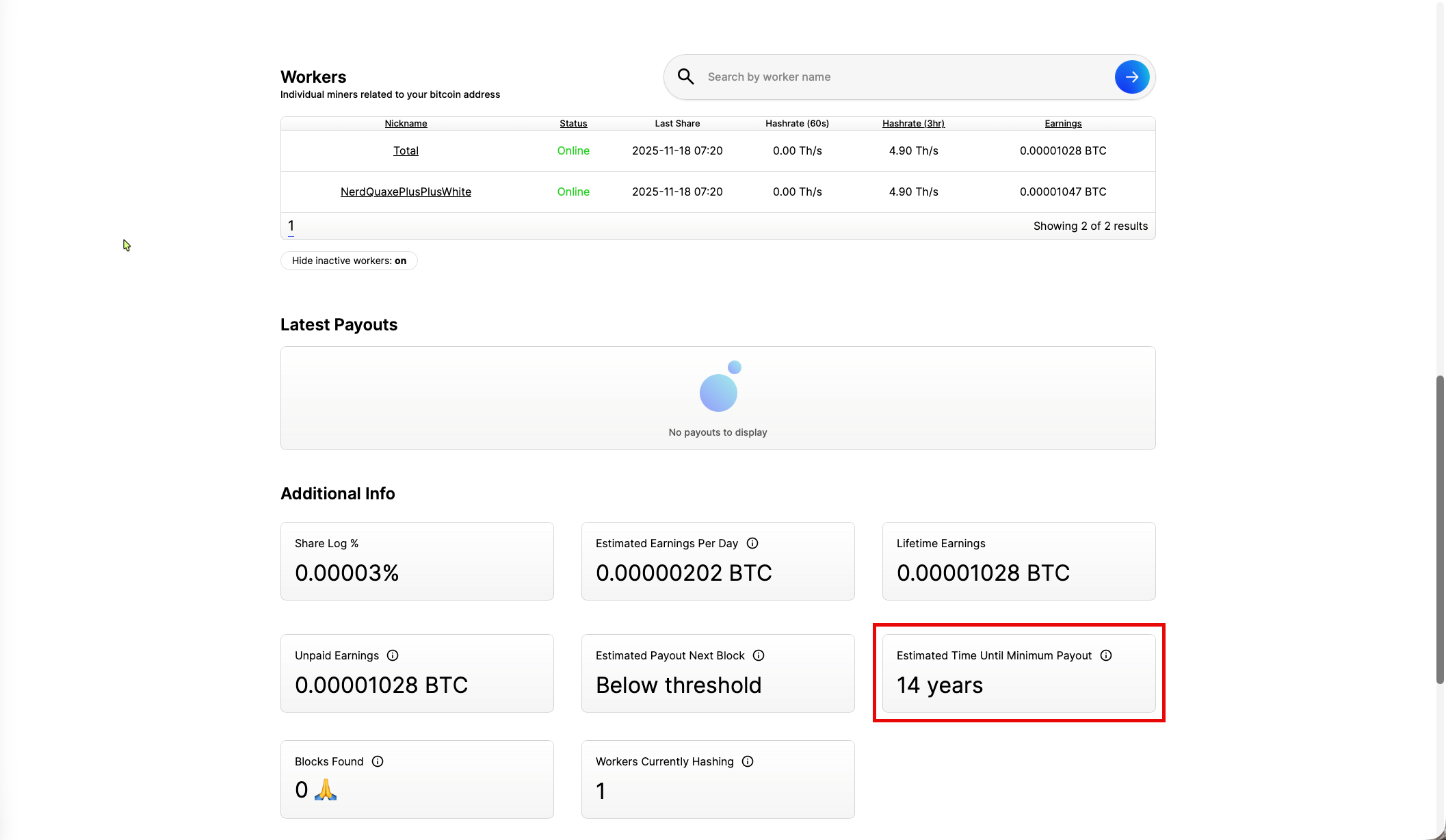

I plugged in my first Bitcoin miner a few weeks ago. The NerdQAxe++ connected to the Ocean.xyz pool, started hashing at 4.8 terahashes per second, and began earning microscopic fractions of Bitcoin. The device hummed quietly. The dashboard showed shares submitted. The rewards trickled in. The first payout would be in ... 14 years.

Then I realized I was trusting Ocean's infrastructure for everything—block templates, payout calculations, transaction selection. I was mining Bitcoin while depending entirely on someone else's servers to tell me what to mine and when I'd get paid.

That's when I discovered I could run the whole stack myself.

Starting simple: Pool mining with NerdQAxe++

The NerdQAxe++ is purpose-built for home Bitcoin mining. It's not competing with industrial operations—those run warehouses full of ASICs pushing hundreds of exahashes. This is a desktop device about the size of a small router, consuming 72 watts while delivering 4.8 TH/s.

Technical specifications:

- Hashrate: 4.8 TH/s

- Power consumption: 72W

- Efficiency: 15 J/TH

- Mining chips: 4 ASICs in parallel

- Networking: Standard Ethernet

- Cooling: Single fan, moderate noise

- Price: ~$450

Setup took ten minutes. Connect power. Connect Ethernet. Access the web interface at the device's IP address. Point it at Ocean.xyz's mining pool. Enter my Bitcoin wallet address. Start mining.

The device calculates 4.8 trillion hashes every second, searching for a valid block solution. When Ocean's pool collectively solves a block, the 3.125 BTC reward gets distributed proportionally among all miners based on contributed work. My 4.8 TH/s is a tiny fraction of Ocean's total hashrate, which means I receive a tiny fraction of each block reward.

Earnings average $3-5 worth of Bitcoin per week. Electricity costs about $5 per month. The economics barely break even, but I'm accumulating Bitcoin while participating directly in the network.

This worked fine for several weeks. Then I started asking questions.

The realization: Why trust Ocean's infrastructure?

Pool mining is convenient. You point your hardware at a URL, and the pool handles everything:

- Constructs block templates with selected transactions

- Distributes work to all connected miners

- Tracks submitted shares for payout calculation

- Broadcasts solved blocks to the network

- Manages payout thresholds and transaction fees

This creates dependencies. You're trusting Ocean to:

- Select transactions fairly (not censoring or prioritizing politically)

- Calculate payouts accurately

- Actually pay you when thresholds are met

- Stay online reliably

- Not suffer outages, hacks, or regulatory seizures

Most pools operate honestly. Ocean in particular emphasizes transparency and DATUM protocol for decentralized template building. But you're still outsourcing control.

The alternative is running your own infrastructure, your own Bitcoin node, your own mining pool software, your own everything.

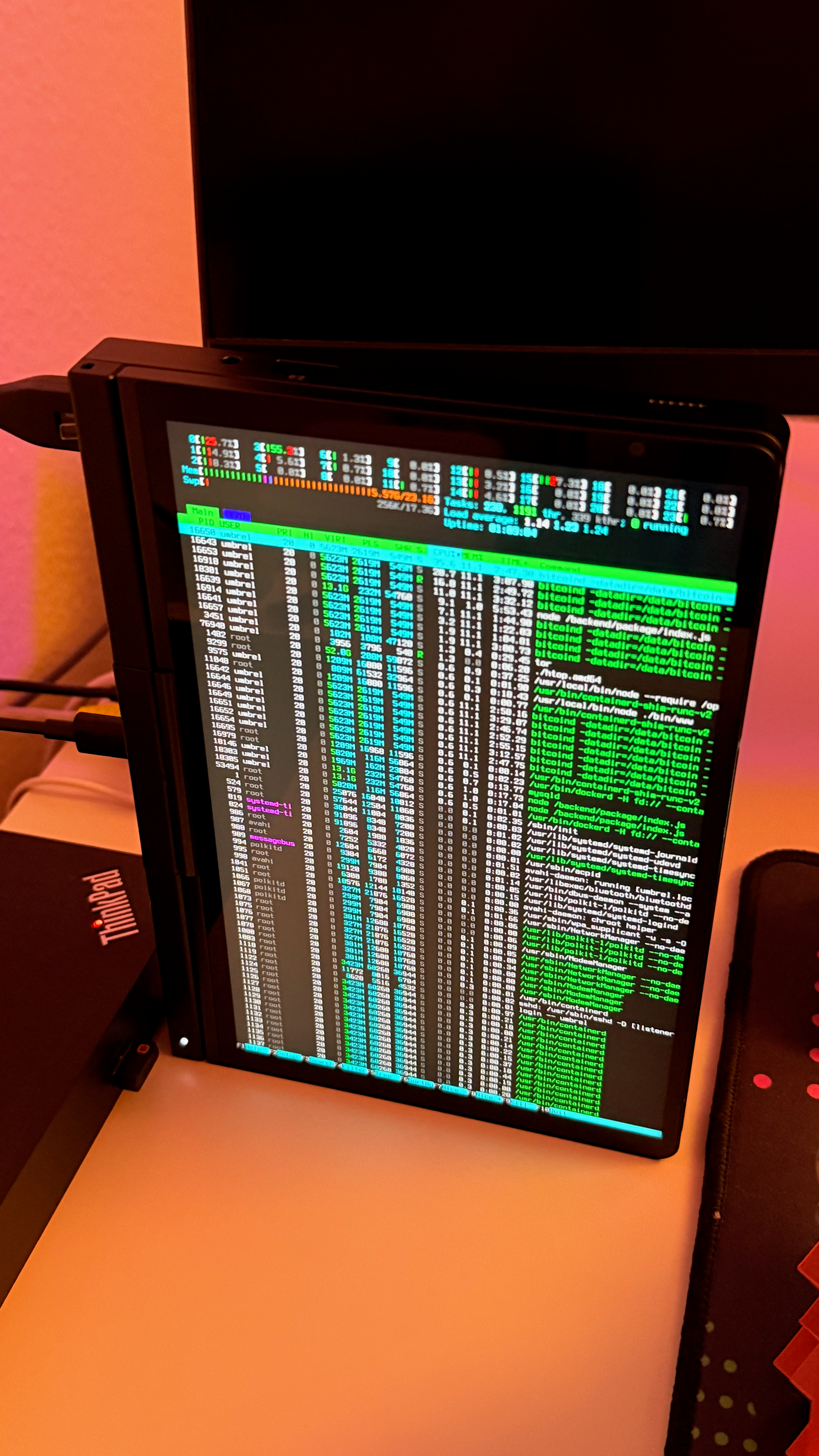

I had a spare computer sitting unused. GPD Pocket 4 with Ryzen 9, 32GB RAM, and 2TB SSD storage. It was overpowered for casual use, which made it perfect for running a full Bitcoin node.

Umbrel OS: Turning a computer into Bitcoin infrastructure

Umbrel OS is an operating system built specifically for self-hosting. At its core, it's a minimal Linux distribution running Docker containers orchestrated through a clean web interface. You install it once, then manage everything through your browser.

The installation process is straightforward:

Step 1: Download Umbrel OS image from umbrel.com

Step 2: Flash the image to a USB drive using Balena Etcher

Step 3: Boot your computer from the USB drive

Step 4: Point the installer at the HD it should use

Step 5: Reboot

Step 6: Connect a browser to the umbrel.local server.

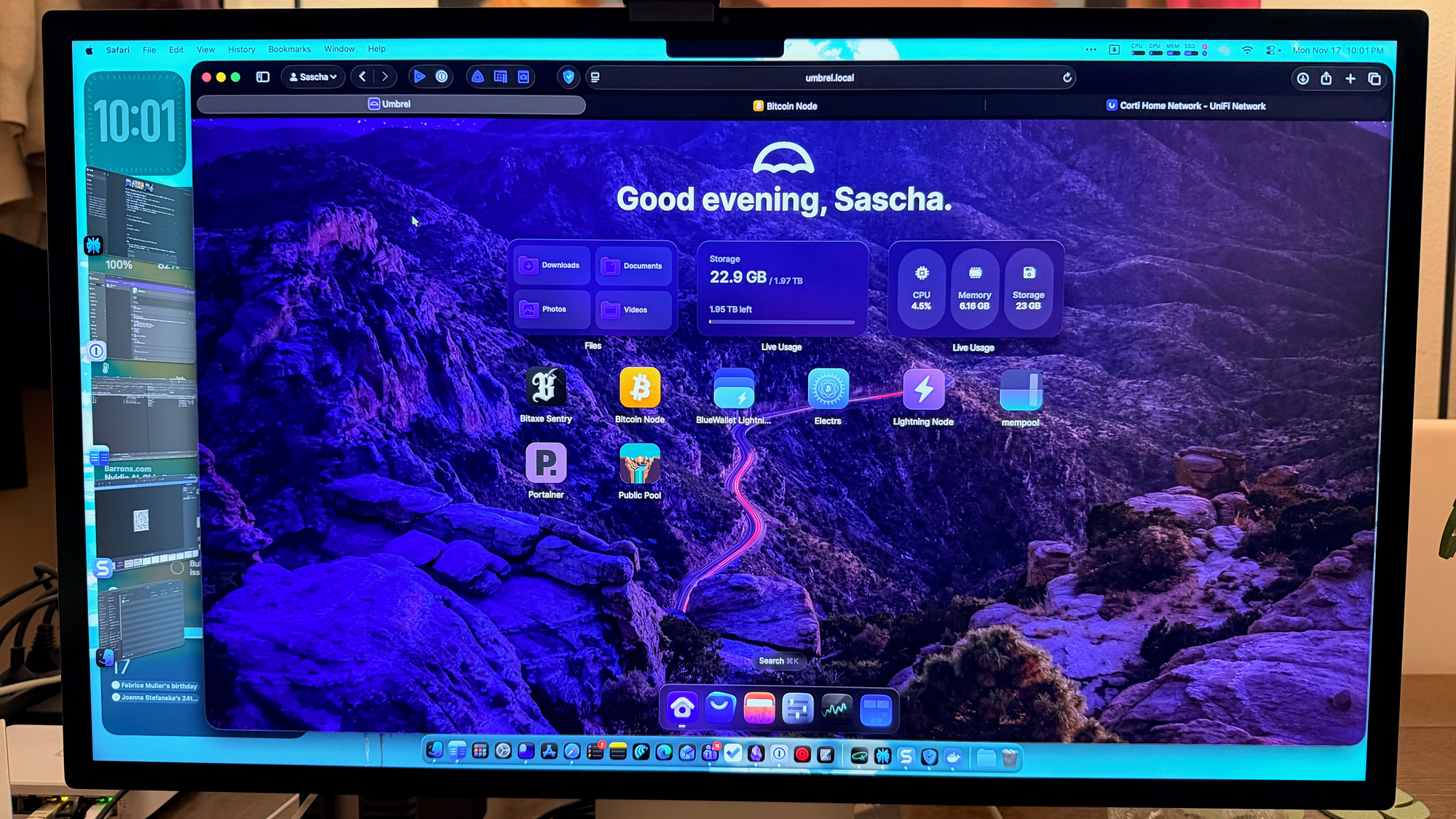

Fifteen minutes later, you're running Umbrel OS. Access the dashboard at your device's local IP address. You see a grid of available applications—Bitcoin Core, Lightning Network, mining pool software, file storage, media servers, all containerized and click-to-install.

The architecture is elegant: bare OS running Docker containers for everything. Each service is isolated in its own container with proper networking and volume management. No dependency conflicts. No sprawling installations across your filesystem. Need to remove something? Delete the container. Everything stays clean.

Bitcoin Core was the first installation. The app installs Bitcoin Core in a container, configures it automatically, and starts syncing the blockchain. This is the crucial piece—your own copy of Bitcoin's complete transaction history, verified cryptographically from the genesis block in 2009 to present.

Blockchain sync: 900GB of verification

The Bitcoin blockchain currently requires about 900GB of storage. It grows roughly 60GB per year as new blocks are mined. Your node downloads every block, verifies every transaction, and builds your independent copy of the ledger.

This takes three to four days depending on your internet connection and computer hardware. Umbrel shows progress in real-time.

The sync is computationally intensive. Your CPU verifies signatures, checks proof-of-work, validates transaction scripts. This is cryptographic verification, not just downloading data. You're proving to yourself that every transaction in Bitcoin's history follows the protocol rules.

Once synced, your node participates in the Bitcoin network:

- Relays new transactions to peer nodes

- Stores the complete blockchain

- Serves blockchain data to connected wallets

- Validates new blocks as they're mined

Your Bitcoin wallet can now connect directly to your node instead of someone else's server. You check balances by querying your own infrastructure. You broadcast transactions through your own node. You verify incoming payments against your own copy of the blockchain.

This is sovereignty. You're not asking permission or trusting third parties. You're operating infrastructure.

Adding your own mining pool

With Bitcoin Core running, you can install mining pool software. Umbrel offers several options—I installed "Basin" which creates a single-user mining pool pointing at your own Bitcoin node.

The setup is automated:

- Basin software installs in a container

- Configuration automatically points at your Bitcoin Core node

- The pool generates a stratum URL for miners to connect

- You redirect your NerdQAxe++ to your own pool

Instead of mining at Ocean.xyz's pool, I now mine at stratum+tcp://umbrel.local:3333 (my local network address). The NerdQAxe++ connects to my Umbrel server, receives work directly from my Bitcoin node, and submits solutions to my pool software.

This changes the economics entirely.

Solo mining vs pool mining: The real comparison

Pool mining through Ocean:

- My 4.8 TH/s contributes to Ocean's total hashrate

- When Ocean solves a block, rewards distribute proportionally

- I receive ~$3-5 of Bitcoin weekly in small, steady payouts

- Ocean takes a 1-2% fee from my earnings

- Payouts come regardless of whether I personally solved a block

Solo mining through my own node:

- My 4.8 TH/s competes against the entire Bitcoin network

- Bitcoin network currently runs at ~900 exahashes (900,000,000 TH/s)

- My share is 0.00000053% of total network hashrate

- If I solve a block, I receive the full 3.125 BTC reward (~$300,000+)

- If I don't solve a block, I receive nothing

- Expected time to solve a block: 4,144 years

The mathematics are brutal. At current difficulty, my odds are:

- Per day: 1 in 1,513,837

- Per week: 1 in 216,262

- Per month: 1 in 50,462

- Per year: 1 in 4,145

This is genuinely lottery-like probability. You're more likely to be struck by lightning (1 in 15,300 in a given year) than to solve a Bitcoin block with 4.8 TH/s.

Yet it happens. In September 2025, a NerdQAxe++ identical to mine solved block 913,272 on Ocean's pool. The miner made Bitcoin social media headlines. Solo miners with hashrates as low as 126 TH/s have solved blocks in 2025, beating odds of 1 in 36,000 per day.

The cryptographic lottery is fair—every hash has the same probability of success. Most miners never win. Some miners win in their first week. The mathematics doesn't care about fairness or desert.

The decision: Steady micro-income vs lottery ticket

I ran the numbers:

Pool mining economics:

- Electricity cost: $5/month

- Bitcoin earned: $12-20/month

- Net: +$7-15/month (roughly breaks even or small positive)

- Certainty: High (steady weekly deposits)

Solo mining economics:

- Electricity cost: $5/month

- Bitcoin earned: $0/month for ~4,144 years, then $300,000+ one time

- Expected value: Slightly negative accounting for hardware depreciation

- Certainty: Zero (pure lottery)

Pool mining is barely profitable but consistent. Solo mining is probably unprofitable but offers lottery-ticket upside.

I chose to go full in on solo mining against my own infrastructure.

Comparing miners: NerdQAxe++ vs BitAxe Gamma

Before settling on the NerdQAxe++, I researched alternatives. The BitAxe Gamma is the main competitor in the home mining space:

BitAxe Gamma:

- Hashrate: 1.2 TH/s (1/4 of NerdQAxe++)

- Power: 15-20W (about 1/4 of NerdQAxe++)

- Price: ~$120 (about 1/4 of NerdQAxe++)

- Design: Single ASIC chip

- Noise: Nearly silent

- Form factor: Compact PCB with USB power option

The BitAxe is perfectly scaled—you could buy four of them for roughly the same total cost, hashrate, and power consumption as one NerdQAxe++. The advantage would be redundancy (if one fails, you still have three running) and distributed placement (you could put them in different rooms for heating).

The disadvantage is complexity. Four devices means:

- Four power connections

- Four network connections

- Four IP addresses to manage

- Four configuration interfaces

- Four points of potential failure

I valued simplicity. One NerdQAxe++, one power cable, one Ethernet cable, one IP address, one configuration screen. It sits on my desk, hashes continuously, and requires zero maintenance.

What this setup actually delivers

Hardware costs:

- GPD Pocket 4: Already owned (comparable systems: $800-1200)

- 2TB SSD: Already installed (comparable drives: $150-200)

- NerdQAxe++ miner: $450

- Total incremental cost: $450

Operating costs:

- Electricity: ~$7/month (node + miner)

- Internet: Already paying for connection

- Maintenance: Zero so far (3 months running)

Returns:

- Privacy: Complete transaction sovereignty

- Control: No third-party dependencies

- Education: Deep understanding of Bitcoin's technical operation

- Lottery ticket: 1 in 4,145 annual chance at $300,000+ windfall

The financial equation doesn't itself. The value comes from sovereignty and learning.

When I send Bitcoin now, my wallet connects to my node. I see my transaction hit my local mempool, then propagate to my peer nodes, then get included in a block that my node validates. I'm not checking Blockchain.com's explorer or trusting Coinbase's balance display. I'm querying my own infrastructure.

The NerdQAxe++ gives me direct participation in Bitcoin's proof-of-work consensus. Every hash it calculates is an attempt to solve the current block. Every ten minutes when someone solves a block, I understand viscerally how improbable that success is. The mining itself is education.

The surprising part: How simple Umbrel makes this

The most remarkable aspect of this entire setup is how simple Umbrel OS made it. No command-line configuration. No editing of bitcoin.conf files. No manual compilation of software. No debugging of port forwarding or firewall rules.

Everything is click-and-install through a web interface. The containerized architecture means nothing can break anything else. Updates are one-click. Backups are automated. Service logs are accessible but not required for daily operation.

I expected this to be a weekend project requiring Linux expertise and troubleshooting skills. It took less time than installing Ubuntu and setting up basic productivity software.

This accessibility matters. Bitcoin's long-term security depends on decentralization. Thousands of independent nodes validating the blockchain rather than everyone trusting a handful of major services. The easier it is to run a node, the more people will run nodes. The more nodes exist, the more resilient Bitcoin becomes.

Umbrel lowers the barrier from "Linux administrator hobby project" to "anyone with a spare computer and an afternoon." The container architecture makes experimentation safe, you can install and remove services without breaking anything.

My GPD Pocket 4 now runs:

- Bitcoin Core (full node)

- Lightning Network (payment channels)

- Solo mining pool (optional lottery tickets)

- Encrypted file storage

All of this on a bare operating system with containerized services. The machine uses about 60W continuously, about the same as a bright light bulb. It sits on my desk, handles everything silently, and requires no maintenance.

Would I recommend this?

You should build this setup if:

- You want complete sovereignty over Bitcoin transactions

- You're willing to accept marginal or negative mining ROI

- You have a spare computer (or $800+ to buy one)

- You have reliable power and internet

- You want to understand Bitcoin's technical operation deeply

You should not build this setup if:

- Your goal is maximizing Bitcoin accumulation (just buy it)

- You need profitable mining (industrial scale is required)

- You want passive income (this requires active learning)

- You're not comfortable with basic technical setup

The mining itself is borderline irrational economically. At 4.8 TH/s, you're barely breaking even in a pool and probably losing money over time when accounting for hardware depreciation. Solo mining is pure lottery with 4,000-year expected time to success.

The node infrastructure justifies everything else. Sovereign control over your Bitcoin transactions, complete privacy, no third-party dependencies, and deep technical understanding of how Bitcoin actually works. The mining adds lottery-ticket upside and educational value about proof-of-work consensus.

I built this setup because I wanted to understand Bitcoin as a technical system, not just hold it as an asset. Three months in, I understand transaction validation, mempool dynamics, proof-of-work difficulty adjustments, and UTXO management at a level that's impossible from just reading documentation.

The NerdQAxe++ mines blocks while teaching me why mining works the way it does. My Umbrel node validates transactions while demonstrating what blockchain verification actually means. The combination transforms Bitcoin from abstract concept to concrete infrastructure I control.

For $450 and a spare computer, I have my own Bitcoin mining and node operation. The expected financial return is approximately zero. The actual value depends entirely on what you think sovereignty and education are worth.